This episode of the Freakonomics podcast, four years after it was initially published, is still an incredibly incisive and enlightening listen.

Titled The Stupidest Thing You Can Do With Your Money, it speaks to a hugely flawed, but highly prevalent misconception in investing.

The idea that if you have access to the smartest people who have access to the best data, you can beat the market.

And, that it’s worth paying a lot of money to access the expertise of those people.

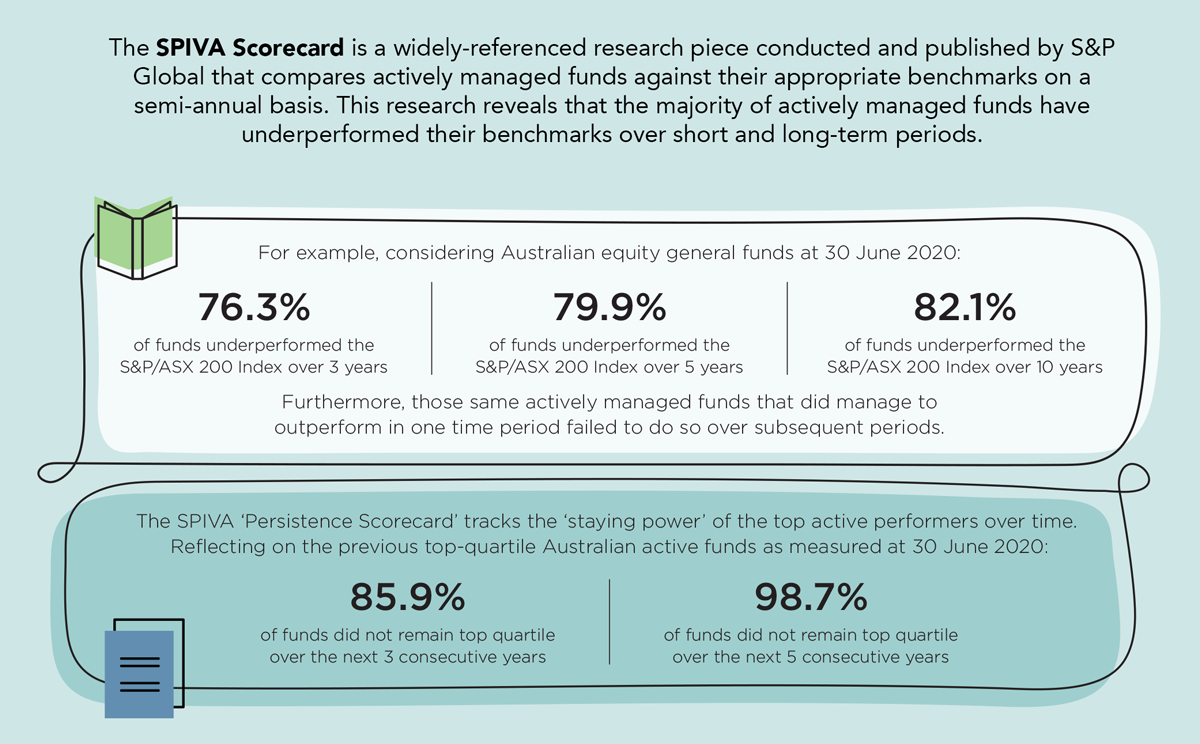

But if you are actually interested in evidence, here’s some data that punctures the hot air in those tyres:

Regrettably, paying a lot of money to someone to manage your investments with the goal (read: hope) of delivering big returns, is what most people think financial advice is.

This is more accurately defined as investment advice and, as the evidence above patently shows, you should NOT pay a premium price to a financial adviser for their purported investment expertise.

As anyone who is a client of ours knows, financial planning done right:

- Provides a knowledgeable “thinking partner” for conversations about life and finances.

- Delivers highly personalised and tailored advice to each person’s current situation and future goals.

- Offers the emotional and financial benefits of being organised and having a plan.

- Goes way beyond investments to include tax planning, cash management, debt management and the leveraging of tools like superannuation.

- Builds a lasting and sustainable platform for wealth creation on strong foundations created by the basics of good financial management.

The smartest thing to do with your money

So if the stupidest thing to do with your money is paying lots of money to beat the market, what’s the smartest thing to do with your money?

Well, the answer for you is particular to you.

To see how vastly different ‘good financial advice’ looks for different people depending on their individual situations, have a look at some of our case studies:

Life after farming: When farmers Graeme and Victoria first came to us, it was with the goal of reducing their insurance premiums and simplifying their super. What they got was much more – a plan for the future where they transitioned from farming into a comfortable retirement.

Retirement planning: When Jim and Susan came to see us for the first time, they were five and twelve years away from retirement respectively. The financial planning advice we gave them for the future also netted them big savings in the present.

Confidently spending money in retirement: Grace was already retired when she first came to see us at the age of 72. She was living very frugally out of fear that she would run out of money one day. We were able to give her the confidence about what she could spend to make her lifestyle more comfortable and even plan holidays for the future.

Navigating income and TPD insurance claim options with confidence: Before coming to see us, Lisa lived with a considerable fear of the financial choices she had to make. Today she enjoys the peace of mind that comes from being mortgage-free, knowing her current income is secure and that her retirement is planned for and structured for success.

You don’t know what you don’t know: Ben and Sarah came to us from another firm who’d only been providing them with advice around their investments, paying fees higher than what we charge for advice that covers all aspects of financial life planning. We were able to create considerable yearly savings for them while also setting them up with a sustainable plan for the future.

GESB West State Super retirement planning: Rob and Marie were in their early sixties when they were referred to us by their daughter with the aim of retiring as soon as they possibly could. We were able to generate considerable tax savings for them and set them up for a comfortable retirement on a timeline they were happy with.

Making the most of excess income: Frank is like many of the high-income medical professionals we work with – he loves his work so he works a lot and spends far less than he could. This sees a large portion of his disposable income going unspent. Frank told us he knew that built up cash could be working harder for him elsewhere, but he just wasn’t sure where that ‘elsewhere’ was. We were able to point him in the right direction.