One old adage about investment is that you buy a bunch of reliable stocks, stick them in your bottom drawer and forget about them. That ignores one pesky fact: Nothing stays the same.

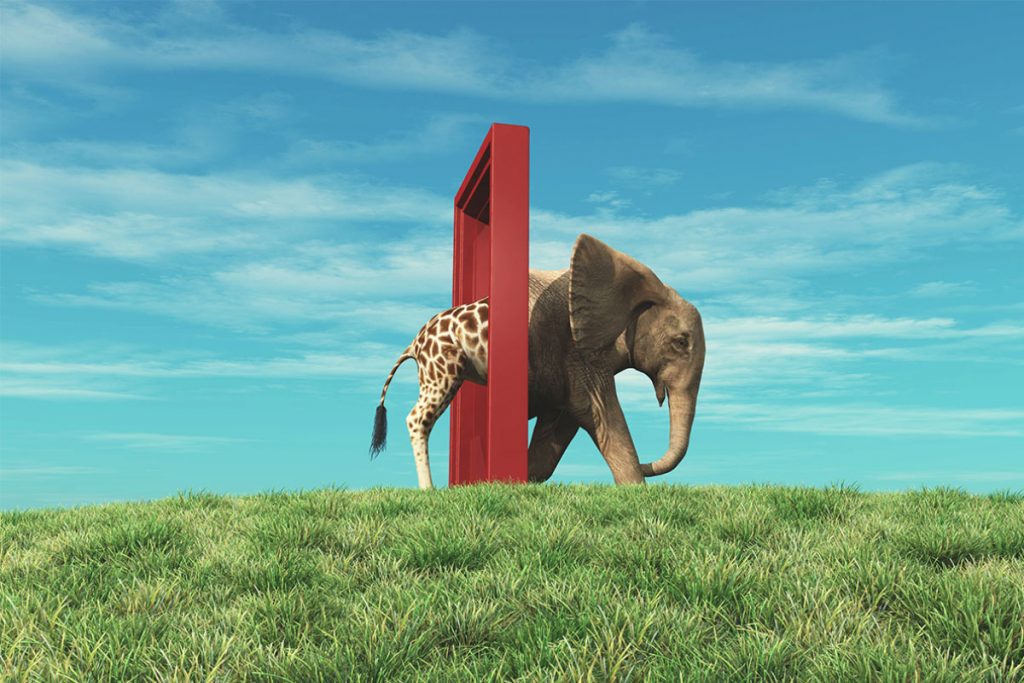

Small stocks don’t always stay that way. Some grow up to become large stocks. Stocks that have low prices relative to fundamental factors like profits, cash flow, dividends or book value can turn into high relative price stocks.

Likewise, companies with large market valuations can turn into small companies over time. And firms characterised as high relative-priced “growth” stocks can transform into low relative-priced “value” stocks.

Price is a measure of how stocks change in character. And we know that prices change from day to day, from hour to hour, from minute to minute and even from second to second. And what moves prices is news.

For instance, the share price of Australian airline Qantas recently staged its biggest one-day rise in nearly seven years after the company posted an annual profit that exceeded collective market expectations. The 14% price rise was achieved on volumes almost three times the stock’s three-month average.1

The point here is that prices don’t tend to change on anticipated information. Prices change on news. And the definition of news is something that is out of the ordinary, unexpected, noteworthy or that makes people sit up and take notice.

Of course, prices don’t always change as dramatically or suddenly as in the Qantas example. Individual stocks can move gradually and incrementally over months or years in a way that takes them from one dimension of expected returns to another.

This helps explain why just sticking a bunch of stocks in the bottom drawer can be a sub-optimal way to build a portfolio. It also helps explain why simply tracking an index is not the ideal way of capturing the returns that the market offers.

Markets are unpredictable. And the premiums that are on offer aren’t there all the time. Even if you rebalance the stocks in your portfolio once, twice or even four times a year, you risk acting on stale information and out-of-date prices.

Some people reckon you can time these premiums and get into the market just in time for them to kick in and get out of the market just as they have run their course. Trouble is there’s little evidence that anyone can do that consistently, reliably or without running up huge costs that wipe out any premium they might earn.

Another approach is to rebalance the portfolio continuously so that the same stocks are not asked to do all the work in delivering the investment strategy.

Continuous rebalancing means you sell securities that have gone up in price to the point where they are no longer part of the dimension of returns you are seeking to capture. These are stocks that now offer low expected returns.

The proceeds from selling can be used to buy back into new opportunities – in other words, into the stocks that are now in the higher expected return areas of the market.

In doing this, of course, you have to be mindful of the cost of the transactions, the tax impact and the other frictions in capital markets. But essentially the strategy is about buying securities when their prices are low (and their expected returns are high) and selling them when their prices are high (and their expected returns are low).

This approach isn’t primarily about individual stocks, mind you. It’s about targeting those parts of the market where the expected returns are highest and being mindful that stocks can move in and out of these dimensions of return all the time.

In a nutshell, that’s what Dimensional does. It’s a process based on rigorous research. It’s a continuous process. And it’s a process that takes heed of real-world concerns, like costs, news and price movements.

You could call it ‘top drawer’ investment.