It’s a widely known fact that small business owners are notoriously bad at paying themselves super. Mostly because:

- Those who are sole traders or in partnerships are not required by law to make super contributions to themselves.

- When you’re caught up in the day-to-day demands of running a business, looking ahead to the future and retirement is difficult.

- It’s often easier to justify investing any excess funds back into the business or towards paying down debt than it is to put money into super.

This means self-employed people tend to have lower super balances than employees across all ages. The average account balance for self-employed males aged 60-64 sits at around $143,000, while it’s around $282,000 for male wage and salary earners. For self-employed women aged 60-64 the average is $83,000 versus $175,000 for wage and salary earners (according to the Association of Superannuation Funds of Australia’s 2018 report on Superannuation balances of the self-employed).

While there are certainly situations and seasons where paying super can be a low priority for small business owners, it’s almost always a good idea to give it close consideration. Here are five reasons why.

1. It’s a good (and rewarding!) financial habit

Good financial habits breed other good financial habits. Making it a priority to pay yourself super – even if it’s a small amount each week or month is a great financial habit to get into. It ensures you are operating on the mindset of setting yourself up for the future instead of only ever focusing on the now.

2. You might get a bigger than usual tax deduction

There are two main types of super contributions:

- Concessional

- Non-concessional

While non-concessional contributions do not offer an immediate tax benefit, you do receive a tax deduction on concessional contributions, capped at $27,500 per year. However, if you haven’t used your $27,500 cap in previous years, you have the very useful opportunity to contribute more than the $27,500 cap and receive an even greater tax deduction. (This is called the carry-forward of unused concessional contributions.)

3. Super often provides an important level of insurance cover

Super is an excellent vehicle within which to tax-effectively obtain and hold personal insurance cover.

As a starting point, life insurance is particularly suitable to be held inside your super. It pays a lump sum to your family if you pass away or become terminally ill.

TPD insurance also often has a place to be held inside super, (though there are some restrictions to be aware of here). TPD insurance pays a lump sum amount if you become totally and permanently disabled.

The other insurance cover that may be held inside super, with some conditions, is income protection insurance, sometimes referred to as salary continuance cover, which can pay up to 75% of your pre-tax income for a set time period if you’re unable to work.

4. You might get a Government top-up ($500) or tax offset ($540)

The Australian Government has a super co-contribution initiative that aims to help boost the retirement savings of low and middle-income earners.

If you have a yearly income of less than $56,112 (before tax), and you meet the eligibility criteria, the Government will match 50 cents for every $1 that you add to your super from your after-tax income up to $500 a year. This might not seem like a large amount but over 15-20 years can have a significant impact on your super balance.

Furthermore, you are entitled to a tax offset of up to $540 if you make a contribution of $3,000 for your spouse if they aren’t working or their assessable income is less than $40,000. Read here for the other eligibility criteria.

5. It’s an invisible but effective way to leverage the power of compound interest

What’s compound interest?

It’s when interest is calculated on both the initial principal amount AND the accumulated interest on money borrowed or invested.

Why should you care about compound interest?

Because those who are able to apply it to invested funds over an extended period of time reap considerable rewards. (So much so, Albert Einstein was said to have called compound interest the Eighth Wonder of the World.)

Here’s an example of how it works.

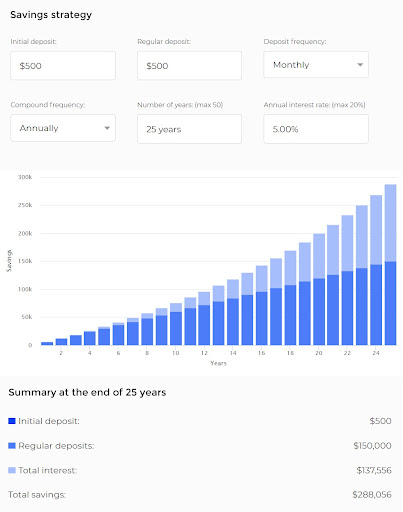

Let’s say you decide to save $500/month for 25 years and put that money in a shoebox under your bed. At the end of 25 years, you’ll have $150,000 in that shoebox. Not bad!

If you take that same $500/month, however, and put it in an investment where you receive a 5% return compounding annually, you’ll end up with $288,056 after 25 years. Almost double what you started with, and a much better return than the ‘squirrelling it away in a shoebox’ method!

What does this have to do with you, the small business owner, and super?

Well, by contributing regularly to super, you are also leveraging the power of compound interest.

And the best thing is, even a small contribution every week can yield big returns over time.

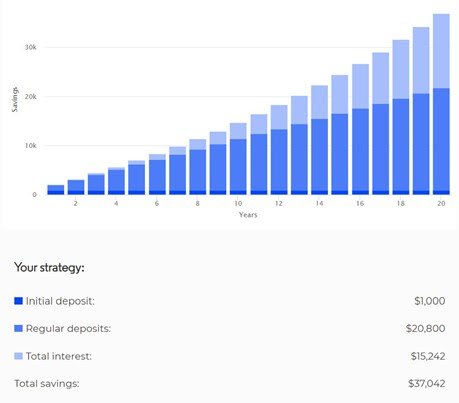

Here’s what an initial super balance of $1,000 plus a weekly contribution of $20 (after tax) per week can look like over time (assuming 5% return compounding annually).

The other best thing about super is that it’s an investment that you can’t touch. Since you can’t access it until retirement, you won’t ever find yourself in a position where you’re tempted to plunder it to prop up your business.

Most powerfully, however, making super contributions also ensures that even if things don’t work out for your business, you still have something to show for all the hard work you put in.

—

Graphs via: https://moneysmart.gov.au/budgeting/compound-interest-calculator

This information is of a general nature only and has not taken into account your particular circumstances. Before making any decision to act, you should consider whether the strategies are suitable for your personal situation and needs.