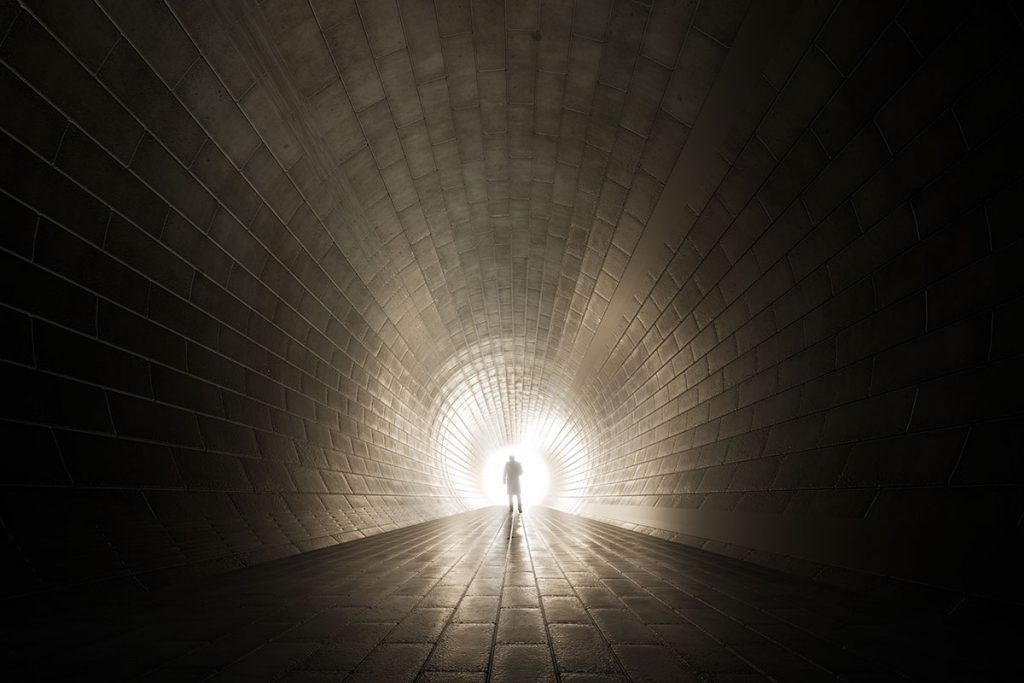

Sound investing for the long term is not just about sticking to your chosen pathway. It also means staying off those investment paths that can derail your journey.

In the 1998 British-American romantic comedy ‘Sliding Doors’, the story revolves around two contrasting life outcomes for the central character, played by Gwyneth Paltrow, all stemming from whether or not she catches a train.

There are ‘Sliding Doors’ in our investment lives as well, often hinging on a momentary and emotionally-driven impulse. Taking one route can lead to a good investment outcome. Taking the other can be harmful.

Imagine a financial sequel to the original move hit. In ‘Sliding Doors II’, the action starts with school teacher Janice Ryan (Sandra Bullock), sitting in her office, biting her lip and looking nervously at her retirement account balance.

It’s March 2009, the financial crisis is in full flight, and Janice, just divorced and with two kids in school, is worried she’ll retire poor. While that date is still 20 years away, she’s nervous enough to think of calling her advisor and asking him to sell all her equity investments.

In the first sliding door of this ‘rom-com’, Janice picks up the phone, reaches her advisor and tells him emphatically: “That’s it! I can’t take it anymore. I want out!” Five minutes later, a text message appears on her phone: “Portfolio liquidated.”

In the alternative story strand, Janice is in the process of dialling her advisor when the principal of her school appears at her desk to introduce her to a new teacher on staff, Stanley Drysdale (George Clooney).

Janice puts down the phone and says hello to Stanley, who it turns out, is also divorced and with kids the same age. She decides to leave the investment decision till another time and have coffee with Stanley instead. (You can guess the rest.)

In version one, Janice comes to regret her impulsive sell order. She quits teaching, takes up a higher paid job that she hates, never gets to meet Stanley and retires on a very modest income. In version two, it’s a much happier outcome.

OK, this is a glamorised Hollywood account of how little decisions have the potential to shape our lives, but it is nevertheless true that our financial wellbeing can be determined as much by the roads we don’t take as those we do.

In the case of a fund management firm like Dimensional, it can be the decision to avoid the temporary pressure on prices caused by stocks going into and out of indexes. Or it can be about excluding stocks that don’t fit the requirements of a particular strategy, or avoiding the effect of upward or downward momentum.

All of these little decisions around strategy implementation – essentially involving avoiding certain pathways – can be as important to the ultimate outcome as the big decisions around portfolio design.

In the case of an individual, it can be about not acting on the buy and sell recommendations of the “experts” on financial television, or not following the herd as it rushes from one individual emerging market to another.

In this, we can see that little decisions can be as important as the big ones. Fleeting impulses that leave no trace in the short term can impose significant and long-lasting footprints on the rest of our financial lives.

Our feelings and fears about investment, particularly when markets are rocky, are perfectly understandable. But, as the British novelist Jane Austen once wrote: “Every impulse of feeling should be guided by reason”.

Put another way, life will always offer us choices, but we are under no compulsion to walk through every sliding door.