In 2022, two 20-year-old businesses – Whitehorn Polglase Financial Planners and 1Life Financial Planners – merged with us. These mergers came at the same time we were celebrating our own 20-year anniversary. As part of the celebrations, we thought we’d get our team to look back over the time they’ve been in the industry and identify 20 money strategies that are as pertinent today as they were 20 years ago.

Here’s what they came up with.

1. Spend less than you earn

We all know that if you spend exactly what you earn, there’s nothing left over as savings or money that can be invested. If you’re spending more than you earn, then you’re either dipping into savings you’ve worked hard to attain or you’re accessing things via credit and going into debt. (Which then means you’re paying more for those things than you should because you’re paying interest on top of the initial purchase price).

While living within your means and ‘spending less than you earn’ sounds super boring, it’s one of the most freeing money strategies you can adopt early on in life and then continue to fall back on all through life.

2. Plan for the future

If you don’t know where you’re going, you’re going to find it hard to get there. Like everything else we aspire to in life, you need to identify your financial and lifestyle goals. Once you know what those goals are, you need a plan that helps you achieve them.

This is obviously something financial planners excel at. But even if you don’t have access to a financial planner, it’s important to regularly sit down and check that where you’re heading is still where you want to go. And then check the plans you have in place are still helping you get there.

3. Live in the now

While planning for the future is important, we never know what’s around the corner. Life is short for even the most long-lived of us, and a life of constant scarcity and sacrifice in the pursuit of future goals can be tedious. So make sure you allocate a portion of your budget to having a comfortable and enjoyable life now if you can.

4. Expect volatility

It’s been said that nothing in life is certain except death and taxes. But there is something else that is certain – nothing stays the same forever. Volatility will occur. If you have the right mindset and setup regarding your investments, then you will always be able to mitigate the effects of volatility and ride out big global events.

5. Don’t try to time the market

While you might achieve higher gains by timing the market perfectly, the chances of you timing the market perfectly are super slim.

So what usually happens is you end up losing at both ends – selling when the market is on its way down and buying back in when it’s on its way back up.

It’s very hard to outperform what you would have achieved by staying fully invested in the market the whole time.

6. Always have an emergency fund

The Barefoot Investor Scott Pape calls it a ‘Mojo account’. Some people call it their ‘cash reserve’. For others, it’s an ‘emergency fund’. Whatever you call it, the principle is the same: at least three months of living expenses sitting in a bank account, never to be touched except in the case of extreme circumstances like losing a job, or having to leave a job or relationship because the situation there has become untenable.

The power of the emergency fund is that it reduces stress and gives you control in situations where stress is extreme and unavoidable and a lot is out of your control.

7. Leverage the power of compound interest

We’ve all heard the quote Einstein is credited for: “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.”

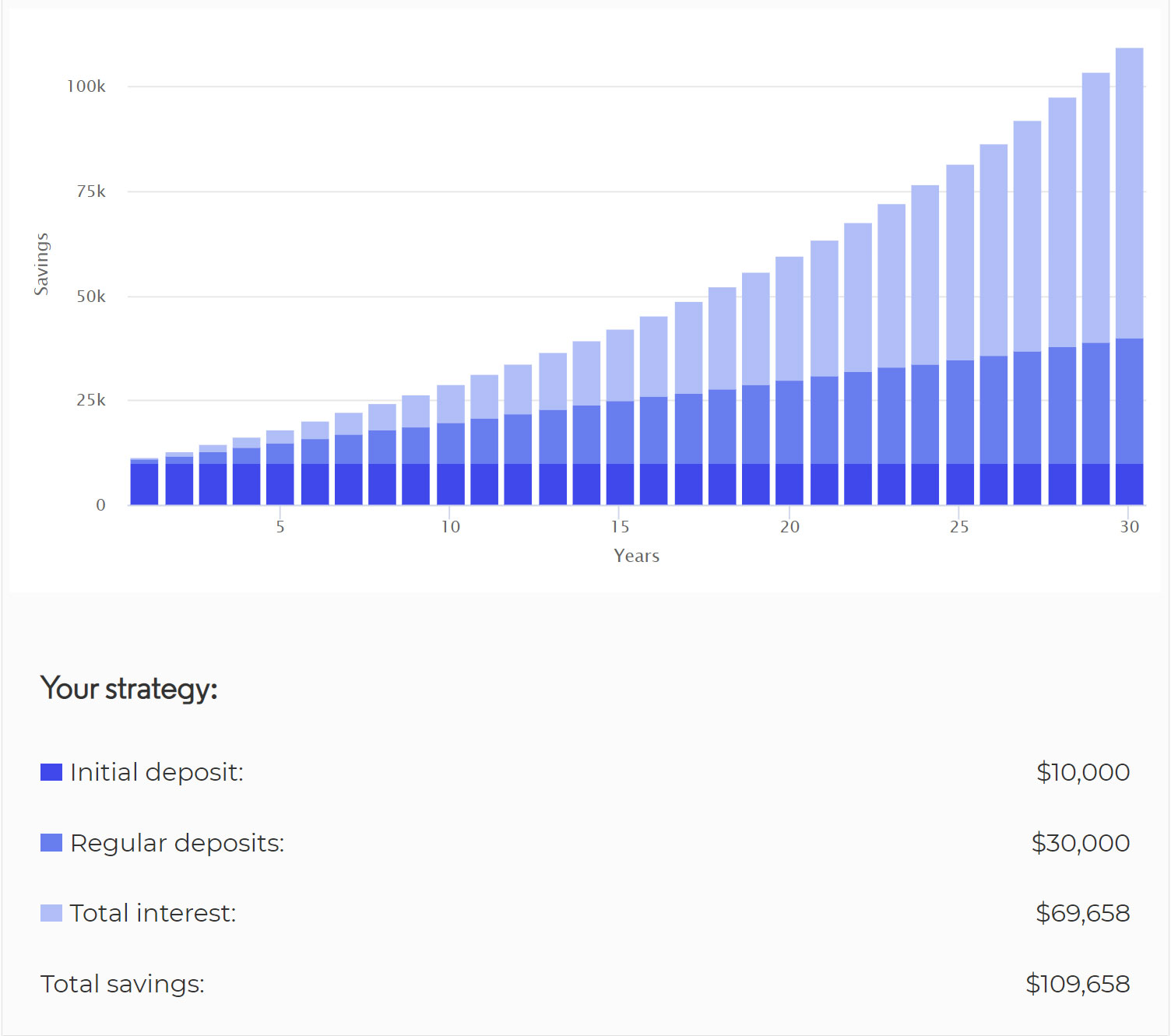

Explained most simply, compound interest is when you earn interest on both the money you’ve saved and the interest you earn. The power of compound interest comes from longevity in investment and is best demonstrated visually. As you can see from the graph below, an initial investment of $10,000, and yearly deposits of $1000 for 30 years ($40,000 total investment) at a 5% annual return becomes $109,658 after 30 years.

Now you might be tempted to file that one away in ‘good for those who’ve got money to invest’ folder. But anyone who is employed is already benefiting from regular contributions and compound interest in the form of their super account.

8. Leverage the power of superannuation

In the world of personal finance, there are many tools and mechanisms you can use to help secure a strong financial situation for yourself, both now and in the future. Superannuation is one of those tools. The beauty of super is that there are also tools within your super account that can be leveraged depending on which super account you’re using and what your personal situation is.

Understanding the avenues open to you via superannuation and utilising those avenues is a money strategy that will absolutely never go out of style.

9. Choose your friends wisely

It takes a huge amount of self-discipline, awareness and confidence to hang out with people who have more disposable income than you do and not get sucked into spending money at the same rate as them (and inevitably, living beyond your means). If you have that discipline and confidence, great. If you don’t, that doesn’t mean you can’t be friends with them, it just means you need to choose where and when you hang out with them carefully.

It’s also easy to find ourselves being friends with people who live well beyond their means and have no dramas relying heavily on credit to fund their lifestyles. Again, it’s not that you can’t be friends with these kinds of people, you just need the discipline and confidence to walk your own sensible path if they try to influence you to operate as they do.

The key thing to be aware of here is that the social circles we move in and the friends we spend time with tend to be a huge influence on how we spend our money. Choosing to spend most of your time with people who have the same money values as you and have a similar level of disposable income is a money strategy that will serve you well throughout life.

10. Diversify

It’s not good to have a single point of failure anywhere in life. But the reality for most of us is that we have a single point of failure with our income because we’re 100% reliant on our job for that.

What can we do to diversify in this regard?

A side hustle that leverages a skill you have and enjoy utilising can allow you to generate additional funds independent of your full-time job. Investing is something you can start doing from a young age and build into a potential income stream by the time you’re in your mid-forties.

And, of course, when you’re investing, diversifying those investments tends to be a very sound strategy for the long term.

11. Pay yourself first

Pay Yourself First is an investor mentality and phrase popular in personal finance. Many financial professionals consider it to be the golden rule of personal finance.

For those who are employed, it involves automatically routing a specified amount into your savings from each pay at the time it is received. For business owners, it requires you to ensure you are quite literally ‘paying yourself’ first and sending a portion of that pay to a savings account.

The most important part of the above equation is that the routing of those amounts into a savings account is a first action, not an ‘only if there is stuff left over to save’ action.

For those who are employed, this habit ensures you always have money on hand for personal expenses when things get tight or the economy worsens.

For those who are business owners, if the unthinkable happens and your business ends up failing, this habit ensures you’re left with something to show for all your effort.

12. Get professional advice

There are many situations where seeking advice from those who have more experience than you can pay dividends in the long term. Issues of personal and business finance are just two of these. We’ve lost count of the number of clients who’ve told us that getting professional advice has, at the very least, given them peace of mind that the financial decisions they’re making are taking into account everything that should be (both from a financial and lifestyle point of view). But of course, there have been many situations where professional advice has paid for itself over and over again in terms of pure numbers.

13. Know the difference between good and bad debt

Good debt refers to money borrowed for things that will help you build wealth or increase your income. Things like mortgages, business loans or loans for study. Bad debt is debt that does little to improve your financial position – now and in the future. The most common form of bad debt is credit card debt or things like store cards and other forms of consumer debt.

The short story here is – not all debt is bad and to be avoided. Knowing the difference will help ensure you make good decisions about the debt you take on.

14. Understand risk and protect yourself against it

Risk is present everywhere in life. With regard to money and personal finance, the most common risks we face are:

- The loss of a house or vehicle

- The loss of sentimental or valuable items

- The loss of our ability to generate income

- The loss of life

Ensuring you have appropriate levels of insurance with regard to the above means you and your family are not just protected from a financial point of view in times of loss, you are also protected from a mental health point of view. Times of loss are hugely stressful and challenging. The financial relief appropriate levels of insurance will give you at these times frees up energy to manage the personal cost of these events.

15. Understand estate planning

Along the lines of the above, it’s really important to know what estate planning is, why it’s important and ensure you’ve put the appropriate things in place.

Estate planning means you have considered how your assets will be managed and distributed after your death. It also considers the management of your properties and financial obligations in the event that you become incapacitated and cannot manage these things for yourself.

In terms of being an important money strategy, it’s important because it ensures the wealth and assets you have built over your life will be distributed and managed in a way that is in line with your wishes should you die. It also ensures that the people you want to control and benefit from your wealth have access to it.

Appropriate estate planning involves having a properly executed will, appointing a trustworthy executor for that will, appointing guardians for dependents and nominating a Power of Attorney for situations where you are incapacitated and need to know that trustworthy decisions are being made.

16. Understand what ‘enough’ looks like for you

It can be so easy to get caught up in ‘bigger, better, more’ mentality and build wealth beyond what you actually need for a happy life that is setting you up well for the future. This mentality usually comes at the cost of family time and being able to live in the ‘now’. So it’s important to understand what ‘enough’ looks like for you personally and regularly check in with yourself that the decisions you’re making and the goals you’re striving for are in line with that (rather than being overly influenced by what the people around you are doing).

17. Run your household like a business

If you run a business, you would have budgets, projections and cashflows. You would reconcile accounts each month, set aside enough for tax, and keep an eye on spending to ensure there is no wastefulness going on.

It pays to run your household in the same way. Know what’s coming in and going out. Check things like monthly subscriptions to ensure you’re actually using them all. Check things like home, car and pet insurance as the ‘standard’ premium increases that occur year on year can add up to hundreds more than you should be paying very quickly.

It’s also essential to ensure you plan and save for irregular expenses.

At the very least, have a basic budget you’re working to and review your income and spending against that budget once a quarter.

18. Track your progress

Sometimes, it can feel like you’re doing a lot of work with regard to your finances but not seeing or feeling any obvious or appreciable benefit. An important part of the service we provide to clients is to show them the progress they’ve made, both over the course of a year and also with regard to their long-term aspirations.

The power of tracking and seeing progress over time is hugely powerful. It provides you with the energy to keep going in the face of challenges and setbacks. And also gives you confidence that all the hard work you’re doing in the ‘now’ is setting you up beautifully for a financially secure future.

19. Consider renting over owning

It’s the great Australian dream to buy your own house. This dream persists even though five Australian capital cities (Sydney, Melbourne, Adelaide, Brisbane and Perth) all featured in this Demographia 20 ‘least affordable housing markets in the world’ report.

We’re not here to talk you out of the great Australian dream (although there are certainly times when we work closely with clients to determine whether they can currently afford this dream).

But what is worth considering is the true cost of buying a holiday home versus renting one each holiday. There is a cost-benefit analysis in these situations that often make a compelling case for renting over owning.

20. Be proud of having a good money mindset

Depending on who you hang around with (see item number nine above), it can sometimes feel ‘uncool’ to be someone who thinks carefully about their money and how they spend it. But it’s important to be proud of having good financial literacy, understanding money, and having a healthy mindset around how you manage your money.

Of all the strategies that will stand the test the time, this one will definitely serve you well for life.