Hello! Here’s the link if you’re looking for the GESB Member Login page.

If you’re looking to find out what makes GESB West State a very SUPER account … read on!

—

In the world of personal finance, you’ll see plenty of ads or blogs promoting amazing returns through blockchain investing or candlestick trading or whatever the latest fad is. But, like most of these things, if it sounds too good to be true, it usually is.

There is, however, one golden egg that gets our financial planning team excited whenever a client of ours has one. And that golden egg is a GESB West State super account.

GESB West State is an untaxed super scheme that was available to WA public sector employees prior to April 2007. It is now closed to new entrants, but there are still many WA public sector employees with a GESB West State account.

What’s so special about GESB West State compared to your everyday super fund?

GESB West State is a Constitutionally Protected Fund (CPF) meaning it runs on a different set of rules compared to your average superannuation account.

1. The contribution limit is subject to a lifetime untaxed plan cap instead of the annual concessional contribution cap

This means that instead of super contributions being limited to the annual concessional contribution cap of $27,500 p.a., individuals with GESB West State have more flexibility in planning for their retirement. They can spend their earlier years putting funds towards paying off the family home, paying for private school education for their children or spending more on themselves during their younger years and then ramp up their contributions later in life.

Don’t be caught out though. Your GESB West State contributions are reported to the ATO and do count towards your concessional cap which is especially relevant if you are also contributing to a typical super fund. If your contributions collectively go over the annual concessional cap, then the ATO will just reflect that you met the concessional cap to the cent, meaning any contributions that you make to other super funds may be deemed excessive.

2. Contributions tax isn’t taken out until the funds are either rolled out or withdrawn from the fund

This is unlike most funds where the tax on contributions is taken out when the contributions hit the account.

This means that you have more of your money invested in the market for longer, and are therefore in a better position to generate higher earnings (in dollar terms), leveraging the benefits of compound interest/returns.

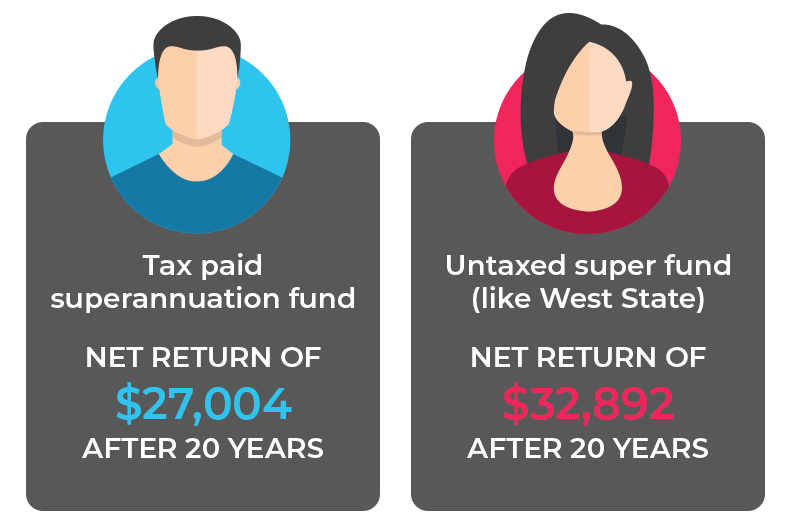

To illustrate the benefits of this, let’s compare two individuals.

Mark is in a tax paid superannuation fund and receives $10,000 of concessional contributions in a financial year. These are taxed at 15% and Mark receives a net $8,500 in his account to invest for 20 years. Assuming a 7% earnings rate net of fees and 15% tax each year he’ll see a net return of $27,004 at the end of a 20-year period.

Mary, with an untaxed fund (like West State) and using the same assumptions, would have an account balance of $38,697 at the end of a 20-year period. If she rolls it into another super fund at this point, she will pay 15% in tax, which would leave her with $32,892 after tax. That’s 20% more in her account for the same investment!

3. The lifetime cap increases each year.

For the last two years, the lifetime cap has increased by $50,000. This is much more than the annual concessional contribution cap of $27,500. This means that even if you have previously hit your lifetime cap, you may still be able to make further contributions as the lifetime cap continues to rise.

When it comes to retirement, if you have accumulated more in your account than the lifetime untaxed plan cap, you can access your super benefits up to the cap (taking advantage of the concessional tax treatment) and leave the remaining funds invested. As the cap continues to index over time, you can access more of your super under the concessional tax arrangements.

—

Ok – now we know what’s special about a GESB West State Super account, let’s take a look at …

Financial advice strategies that we see work well for clients with GESB West State products

1. Transitioning assets held personally into superannuation over time via a drawdown approach.

Usually, when you receive your income into your bank account, you might set aside some money for savings and then spend the rest. As you approach retirement and are comfortable transitioning assets into superannuation, you could sacrifice up to 95% of your income to your GESB West State account. You could then draw down on your savings outside of super over time to fund your cost of living. This way you’re tax-effectively transitioning assets into superannuation over time whilst also funding the cost of living for the household.

2. Maximising your after-tax position after a capital gains event

In a year when you incur a large taxable capital gain such as through the sale of an investment property or shares, you can look at increasing your salary sacrifice to reduce your other taxable income in that financial year and therefore, reduce the amount of tax you need to pay on the realised capital gain.

3. Division 293 tax, and tax on excess concessional contributions can be withdrawn from the account

If you have made excess concessional contributions to another super fund or you are a high-income earner and have received a Division 293 tax bill, the tax payable for either of these can be paid from a GESB West State account. This is beneficial because this is considered a payment from GESB to the ATO and therefore reduces the amount that is counted towards your lifetime cap. Making these payments from your GESB West State account is, therefore, better than funding them personally or paying them from another superannuation account.

For example:

- To pay a Div 293 tax bill of $5,000 from a regular, taxed superannuation account, $5,882 of your regular contributions would be needed to pay this bill, (allowing for 15% contributions tax).

- If paid from GESB West State, only $5,000 is needed to pay the bill (as these contributions are not taxed immediately), saving you $882.

- If you were to pay the bill personally, assuming the highest marginal tax rate, you would have to earn $9,433, pay tax of 45% (plus the 2% medicare levy) to end up with the $5,000 in your bank account needed to pay the bill.

4. Pre and post 1983 service days and the tax components

When exiting GESB West State, there is a calculation based on your pre-1983 service days that is performed, and that you can take advantage of.

Let’s say you began work on 1 January 1980, and you declare retirement on 1 August 2021, during which time you have accumulated $1 million in your GESB West State account. At this point, you elect to roll over all of your balance to pension phase and are now required to pay tax on that figure.

How much tax?

Well, first the percentage of tax-free days (i.e. the number of days you were a member of the super account pre-1983) needs to be figured out. In this example, that number comes to 8.408% (the pre-1983 service days divided by the total number of days between 1 January 1980 and 1 August 2021).

When you roll to pension phase 8.408% of your $1 million balance ($84,080) will be classified as tax-free. The remaining balance of $915,920 is then taxable at 15% (i.e. tax of $137,388), resulting in $862,612 (i.e. $778,532 + $84,080) being rolled to pension phase, after tax.

This is a benefit of $12,612, compared to having no pre-83 service at all, but that’s not the whole story.

Can you take further advantage of this tax-free period? The answer is yes (and this is where it comes in handy having a financial advisor familiar with the mechanisms that a GESB West State fund makes available to you).

Let’s say you’ve seen your advisor and, upon reviewing your situation, they identify $330,000 in cash/liquid assets you had planned to hold onto. Under the bring-forward rules for non-concessional super contributions, you can contribute all of this to your GESB West State super account. And here’s how the maths works out if you do:

- Your balance increases from $1,000,000 to $1,330,000. The non-concessional amount of $330,000 is tax free.

- As your total balance has increased, the 8.408% we calculated before is now being applied to a bigger number. This increases the tax-free pre-83 component from $84,080 to $111,826, and the component of your balance that is taxable at 15% is reduced from $915,920 to $888,174.

- The total balance rolled to pension phase is now $1,196,774, after tax. This gives an extra $4,162, compared to not making the $330,000 contribution. This may not seem like much in the context of a $1 million-plus super balance, but just take a moment to think of what you would do with a $4,000 windfall.

Some other things to be aware of

Here are some other things to be aware of with regard to GESB West State super accounts that might be helpful to you:

- Tax payable on rollovers is paid at 15% on the untaxed element of the taxable component. However, if you withdraw funds, tax is paid at 15% plus the Medicare levy, or higher, depending on your age. If you want to withdraw the funds and don’t have another super fund, it might make sense to set one up, roll over the funds into it, and then withdraw the cash if you need it.

- If you have a GESB Gold State account but not a West State account, you may still be eligible to open a GESB West State account.

- Until recently, GESB did not accept beneficiary nominations on your super balance. It is a very welcome change that GESB has updated their regulations to allow them to accept binding death benefit nominations now. This is one way you can make sure your super goes to your chosen beneficiaries.

- It’s also important to be aware that investment earnings inside a GESB West State account count towards your untaxed plan cap. For this reason, depending on your personal circumstances and long term plan, it might make more sense to roll funds out to an external super fund where they can grow and allow room in your untaxed plan cap for your contributions. Alternatively, it might make sense to roll funds from a taxed plan into your GESB West State account to allow them to grow over time without incurring the tax each and every year, with tax instead applied at the time of rollover or withdrawal.

- Given GESB West State is a closed product, only those who have had it since April 2007 can benefit from it. It’s also important to remember that once a GESB West State account is closed, it cannot be reopened. So, before doing that, you really should consider whether it’s the right decision for you.

Getting your GESB West State super account to work harder for you

The GESB West State super account is a product with high complexity. It’s a tool that works best when supported by someone who understands the complexities and how to best leverage all the strategies and options it offers.

HPH Solutions has financial planners in the Perth, Mandurah and Geraldton offices who know this product extremely well. Feel free to contact us at any time for a preliminary chat about getting financial advice from our specialists in GESB West State Super.