On Tuesday 6 June, the Reserve Bank of Australia (RBA) raised the cash rate to 4.10%. This is the 12th rate rise since May 2022 and the highest the cash rate has been since April 2012.

A key driver of these ongoing rate rises is Australia’s inflation levels which have been sitting above the Reserve Bank’s target (to keep consumer price inflation between 2-3%, on average, over time) for over a year.

What is inflation?

How does it affect everyday Australians?

Can we expect more interest rate rises in the coming months?

Read on for answers to those questions and more.

Covered in this article

- What is inflation?

- What causes inflation?

- What is the CPI and what does it have to do with inflation?

- What is monetary policy?

- What is the cash rate?

- What is Australia’s ideal inflation rate?

- What has caused high inflation in Australia?

- What measures are being taken to lower inflation in Australia?

- How many more interest rate rises will there be?

What is inflation?

The term ‘inflation’ refers to the general increase in prices of goods and services over time. When inflation occurs, each unit of currency buys fewer goods and services than it did before.

So, when inflation occurs in Australia, one Australian dollar buys less than it did before and the value of the Australian dollar goes down.

What causes inflation?

There are a few causes of inflation. The main ones are:

- Demand-pull inflation: This occurs when demand for goods and services surpasses the supply, leading to upward pressure on prices. This is something that often happens during periods of strong economic growth when people have more disposable income.

- Cost-push inflation: This type of inflation results from an increase in the cost of production inputs, such as labour, raw materials, or energy. When businesses face higher costs, they may raise prices to maintain their profit margins.

- Monetary inflation: Monetary inflation happens when there is an increase in the money supply in an economy. If the money supply grows faster than the growth in goods and services, it can lead to rising prices.

What is the CPI, and what does it have to do with inflation?

The CPI (Consumer Price Index) in Australia measures the average price changes of a basket of goods and services consumed by households. Published by the Australian Bureau of Statistics (ABS), it is an important indicator of inflation. The CPI is composed of various expenditure categories, each representing a different component of household spending. The main components of the CPI in Australia are as follows:

- Food and non-alcoholic beverages

- Alcohol and tobacco

- Clothing and footwear

- Housing

- Furnishings, household equipment, and services

- Health

- Transportation

- Communication

- Recreation and culture

- Education

- Insurance and financial services

- Other goods and services

These categories are assigned different weights based on their relative importance in household spending. The CPI is calculated by tracking the price changes of representative goods and services within each of these categories over time.

To decide which goods and services to include in the CPI basket and what their weights should be, the ABS uses information about what Australians are spending their income on, and how much. If households spend more of their income on one item, that item will have a larger weight in the CPI.

What is monetary policy?

The RBA is the central bank of Australia and has three key objectives:

- the stability of the currency of Australia;

- the maintenance of full employment in Australia; and

- the economic prosperity and welfare of the people of Australia.

Monetary policy in Australia is the process by which the RBA manages the money supply and interest rates to achieve its objectives.

What is the cash rate?

In technical terms, the cash rate is the interest rate on overnight loans between financial institutions.

In more lay terms, it is the target interest rate set by the RBA.

The cash rate plays a crucial role in influencing short-term interest rates and serves as a key tool for implementing monetary policy.

What is Australia’s ideal inflation rate?

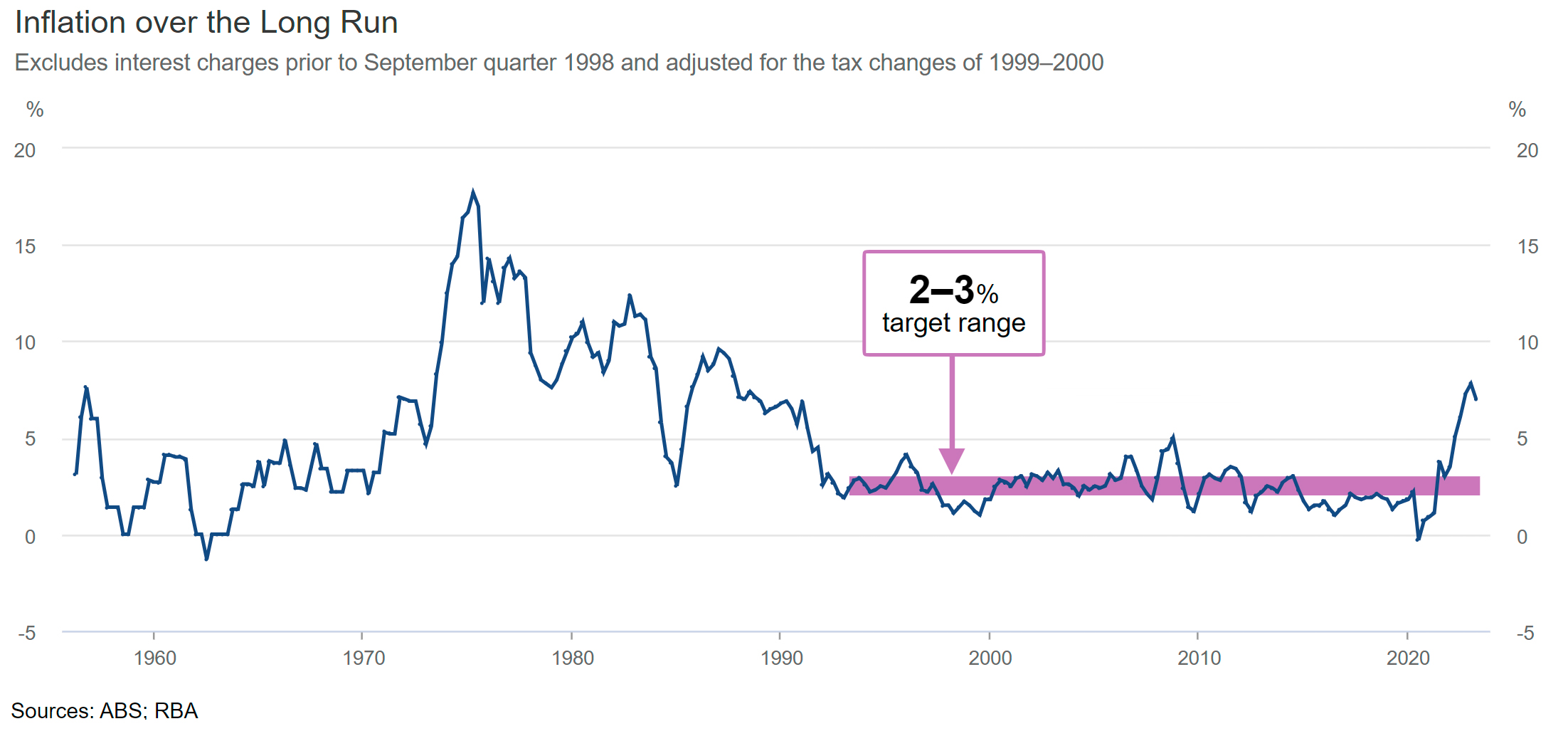

The RBA and the Federal Government have agreed that the appropriate target for monetary policy in Australia is to achieve an inflation rate of 2–3 per cent. The inflation target is defined as a medium-term average rather than as a rate (or band of rates) that must be held at all times.

What has caused high inflation in Australia?

Inflation in Australia started rising from -0.3 in June 2020 and peaked at 7.8% in December 2022.

These rising inflation numbers were caused by a combination of local and international conditions, including:

- The Russian invasion of Ukraine in 2022

- The blockage of gas and other exports

- Ongoing effects of stimulus measures taken by the Australian government during the pandemic

- The accumulation of savings in a large number of Australian households during the pandemic lockdowns (around $240 billion all up by the end of 2021)

With the threat of COVID lockdowns over, the general demand for goods and services is higher than the supply. Australians are also now travelling again, and the high demand for travel has seen costs surge.

What measures are being taken to lower inflation in Australia?

The main tool used to tackle inflation is increasing the cash rate.

On 4 May 2022, the RBA increased the cash rate for the first time since 2010 to counter the rapid post-pandemic rise in inflation. Since then, the RBA has increased the cash rate a further 11 times.

As noted above, the most recent increase on 6 June 2023 sees the cash rate sitting at 4.1% – the highest level in a decade.

How many more interest rate rises will there be?

In his statement on 6 June, RBA Governor Philip Lowe said:

“Inflation in Australia has passed its peak, but at 7 per cent is still too high and it will be some time yet before it is back in the target range. This further increase in interest rates is to provide greater confidence that inflation will return to target within a reasonable timeframe.

The [RBA] Board is still seeking to keep the economy on an even keel as inflation returns to the 2–3 per cent target range, but the path to achieving a soft landing remains a narrow one.

Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe, but that will depend upon how the economy and inflation evolve. The Board will continue to pay close attention to developments in the global economy, trends in household spending, and the outlook for inflation and the labour market. The Board remains resolute in its determination to return inflation to target and will do what is necessary to achieve that.”