With a stark shift in US tariff policy announced on April 2 and ongoing responses worldwide, many investors are on edge. Volatility as measured by the VIX index has spiked to levels not seen in nearly five years.1 But when there is real economic uncertainty and information is quickly changing, volatility is a sign that markets are functioning.

Sudden drops in the market and heightened volatility can be unnerving, as can rapidly changing economic policies. The market’s job is to process uncertainty in real time. When trade policies change swiftly, markets are incorporating a vast amount of information and expectations about how these shifts may shape the global economy. Markets do this on a forward-looking basis, continuously incorporating new information and setting prices so that expected returns are positive.

Economic policies, such as those related to international trade, have financial impacts across the economy beyond market returns. The economic implications that markets almost instantaneously price into securities play out over a longer period in the real economy. This difference in velocity is important to underscore, because it points to a difference in how we experience potentially negative (or positive) economic developments as investors versus as participants in the real economy. Even if you are worried about ongoing economic challenges, you shouldn’t necessarily expect a negative investment experience going forward, because markets have already factored in known information.

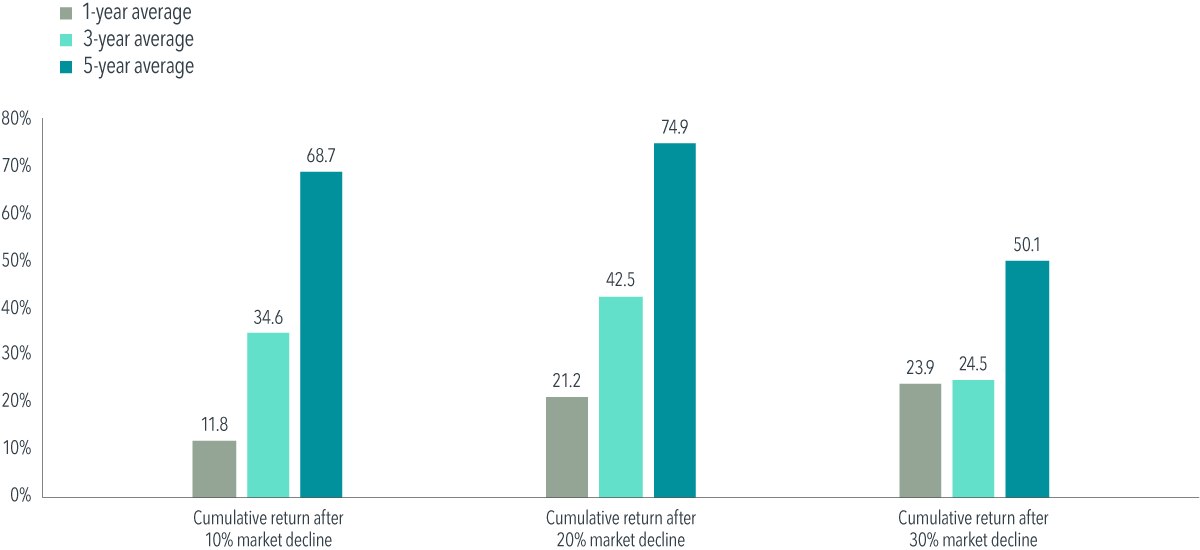

Pain you may feel now reflects markets setting prices such that expected returns are always positive. Exhibit 1 below illustrates that market returns following downturns generally have been positive. When we examine US equity returns following downturns of 10%, 20%, or even 30%, we see one-, three-, and five-year cumulative returns that are positive on average. Viewed in annualised terms across five years, returns after a 20% decline have been close to the US market’s historical average of approximately 10%.2

When your portfolio experiences a sudden drop, generally the most important thing an investor can do is to stay invested and look forward to better days ahead.

Exhibit 1: Market Gains Can Add Up After Big Declines

Fama/French Total US Market Research Index cumulative returns, July 1, 1926–December 31, 2024

Footnotes

- Source: Cboe.

- The average annualized return for the Fama/French Total US Market Research Index for the period July 1, 1926–December 31, 2024, was 10.23%. The average annualized returns for the five-year period after 10% declines were 9.59%; after 20% declines, 10.15%; and after 30% declines, 7.18%.

Disclaimer

This material is issued by DFA Australia Limited (AFS License No. 238093, ABN 46 065 937 671). This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person. Accordingly, to the extent this material constitutes general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. Investors should also consider the Product Disclosure Statement (PDS) and the target market determination (TMD) that have been made for each financial product either issued or distributed by DFA Australia Limited prior to acquiring or continuing to hold any investment. Go to dimensional.com/funds to access a copy of the PDS or the relevant TMD. Any opinions expressed in this material reflect our judgement at the date of publication and are subject to change.