Financial advice for your family

You have worked hard to earn your financial success. That is a huge achievement.

It's now time to put your financial success to work in service of those that matter to you most - your family - by compounding that financial success and building wealth for life.

You can then use that wealth to:

- Protect your loved ones from future financial distress

- Minimise the potential risks in their lives

- Provide confidence for many years to come

- Contribute meaningfully to the community

- Advance the fortunes of others.

In other words, your financial wealth can make more than interest. It can work to stabilise your world and the worlds of those around you.

FOUR TYPES OF FAMILY-RELATED FINANCIAL ADVICE WE PROVIDE

Education is arguably the most valuable investment you can make in your children’s lives. We help you plan and fund it appropriately.

There’s nothing worse than disaster or tragedy striking, only to find out you’re under-insured. Our expertise ensures you are appropriately covered.

We help ensure your wishes are properly documented so your assets are distributed to the right people, at the right time in the right way.

Creating a plan to finance your care after retirement and in the event of incapacitation will empower your future self to be cared for as you see fit

HPH Solutions operates at the intersection of

HEALTH, PROSPERITY AND HAPPINESS

"Money is not the only thing affecting people’s happiness. Money is not the whole story; it’s not remotely the whole story. It’s important we try to get a better balance between income, and human relationships and mental and physical health. People must understand that they would do well to preserve their human relationships; they should give them a higher priority than how much they earn."

~ Professor Lord Richard Layard, London School of Economics

What does it take to live a happy life? Are there differences between people and what part does career choice, personal finances and family background play? There are academics in the field of social science that have devoted their professional life to these questions.

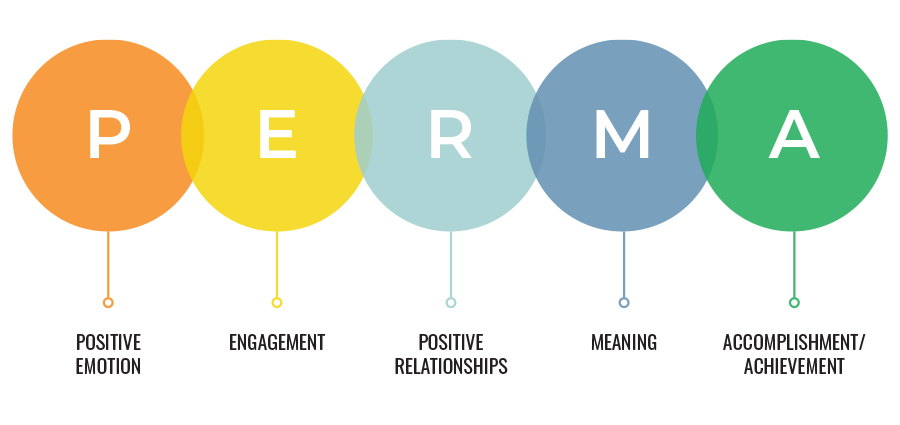

One such social scientist is Dr. Martin Seligman, professor and author of Learned Optimism (1990), Authentic Happiness (2002) and Flourish (2011). In his 2004 TED talk, he shares some of his research, including the surprising finding that the pursuit of pleasure makes almost no contribution to life satisfaction. To better explain happiness, he developed a theoretical model of wellbeing consisting of five elements, which can be remembered by the acronym PERMA.

The science of human flourishing is not new though. Take for example the Harvard Study of Adult Development project which began in 1938 during the Great Depression, tracking the health of 724 men over the course of their life. The project continues today, more than 80 years later. The current director of the study and professor at Harvard Medical School Robert Waldinger remarks:

"The surprising finding is that our relationships and how happy we are in our relationships have a powerful influence on our health. Taking care of your body is important but, tending to your relationships is a form of self-care too. That, I think, is the revelation."

Other academics concur including New York Times bestselling author and Wharton School professor Adam Grant who was asked on his Wondering Blog, "What did all the great thinkers of our time believe was the meaning of life?"

His answer: Connection and Contribution.

You will not be surprised to learn that positive, supportive relationships is a common theme in the research findings of all three academics. Being closely connected to others has proven to be an essential ingredient to personal wellbeing.