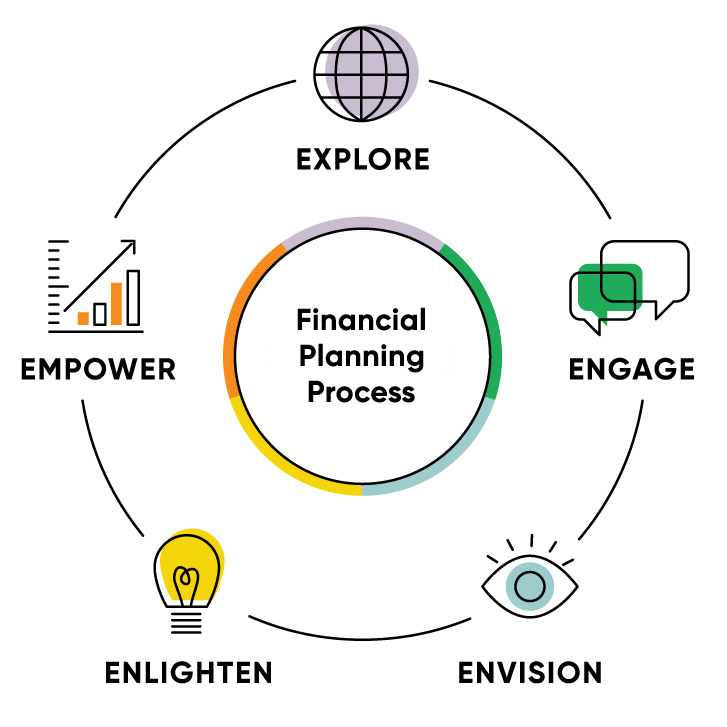

Our Financial Planning process

Our financial planning process is a holistic one that:

- Focuses on increasing your sense of financial well-being and life satisfaction

- Helps you clarify your values, priorities, circumstances, and aspirations

- Guides you in defining and designing your personal vision of a fulfilling life.

We work through a series of five steps with you to create a sound financial life plan that will give you freedom from worry, give you back your personal time and ensure you and your loved ones are always well taken care of.

In this stage, your adviser’s main objective is to gather enough personal and financial information to:

- Understand your main issues and concerns,

- Estimate the scope of the engagement, and

- Verify that the relationship will be a good fit for both parties.

Supported by life-centred exercises and conversation, the important outcome of this stage is that your adviser understands your values and priorities to shape your financial plan.

In this stage, your adviser will summarise and clarify his/her new insights and knowledge about your values, priorities, concerns, transitions, goals and objectives.

The purpose of this stage is to verify understanding of what you have communicated and to reinforce our commitment to put your interests first.

When presenting your financial plan, your adviser will then explain how the financial solutions being proposed, support the life vision and goals you have created.

This stage begins when a commitment has been made – by both your adviser and yourself – to move forward with a working relationship.

Through an in-depth data gathering process, one of the goals in this stage is to understand where you are now in several areas of life as well as the journey that brought you to this point in time.

This insight will help your adviser to understand your unique perspective on a range of life and money issues.

The objective of this fourth stage is to assist you in creating a vision for your future that is compelling, fulfilling, and inspiring.

This mental picture will include everything that is important to you and contributes to your happiness and life satisfaction. The next step is to mutually define personal and financial goals that align with and support that image.

For your adviser, the visualisation and goal setting process will establish clear guidelines for creating a financial plan that is aligned with your values and priorities.

Armed with new insight and knowledge, you will be empowered to take action because of the direct link between the financial advice delivered and your unique perspective of “quality of life”.

Your adviser will continue to act as a guide in this stage, monitoring progress and helping to maintain focus on your personal and financial goals.

Because unanticipated events occur and priorities shift over time, it is important for you and your adviser to regularly review your financial plan to make sure it remains relevant to your life journey.