The stupidest thing you can do with your money

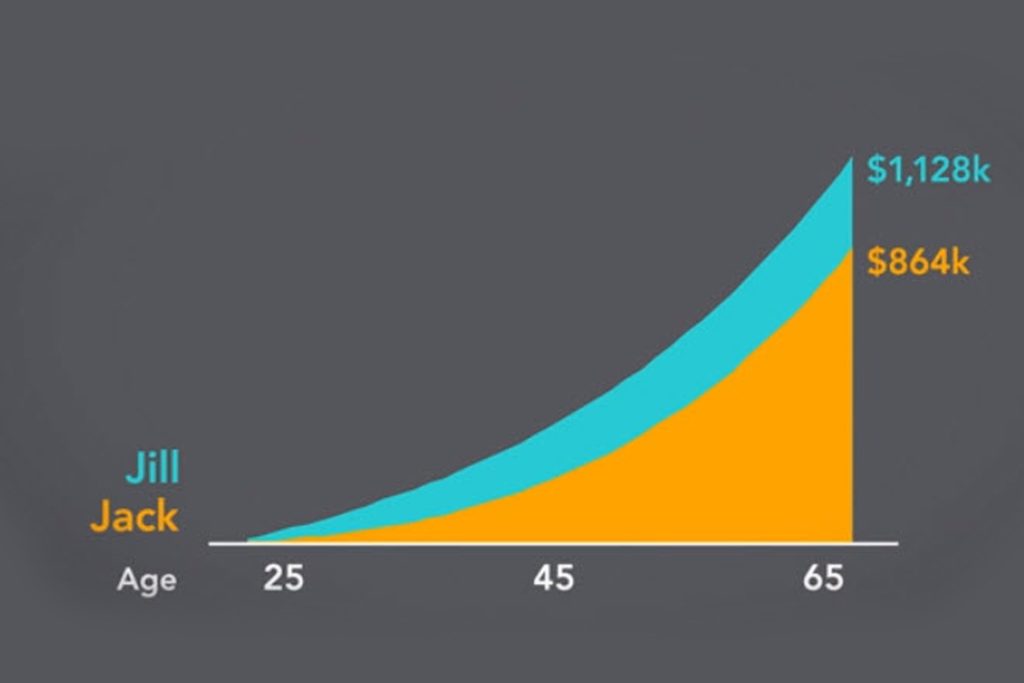

A highly prevalent misconception in investing is that if you have access to the smartest people who have access to the best data, you can beat the market.

The stupidest thing you can do with your money Read More »